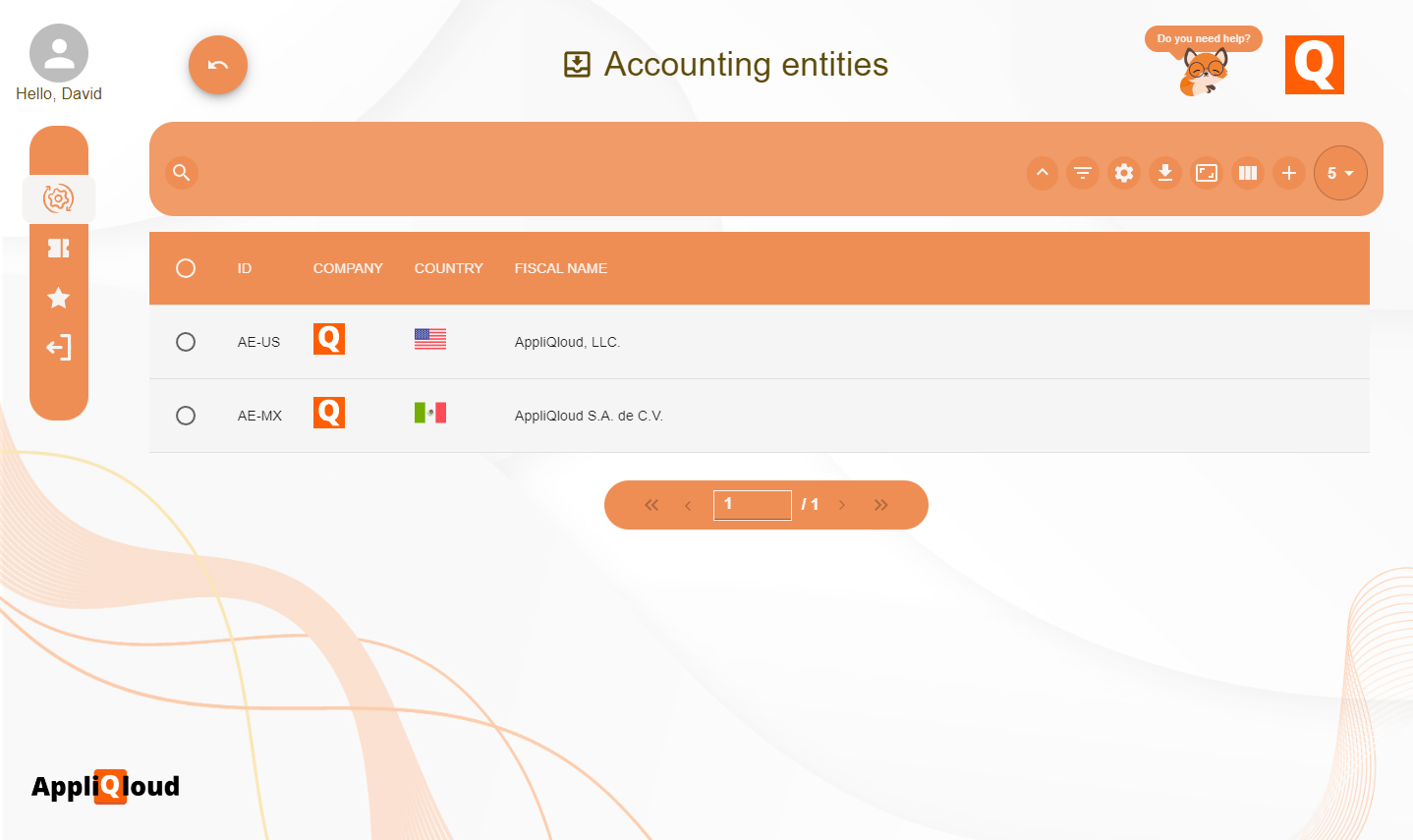

Accounting entities

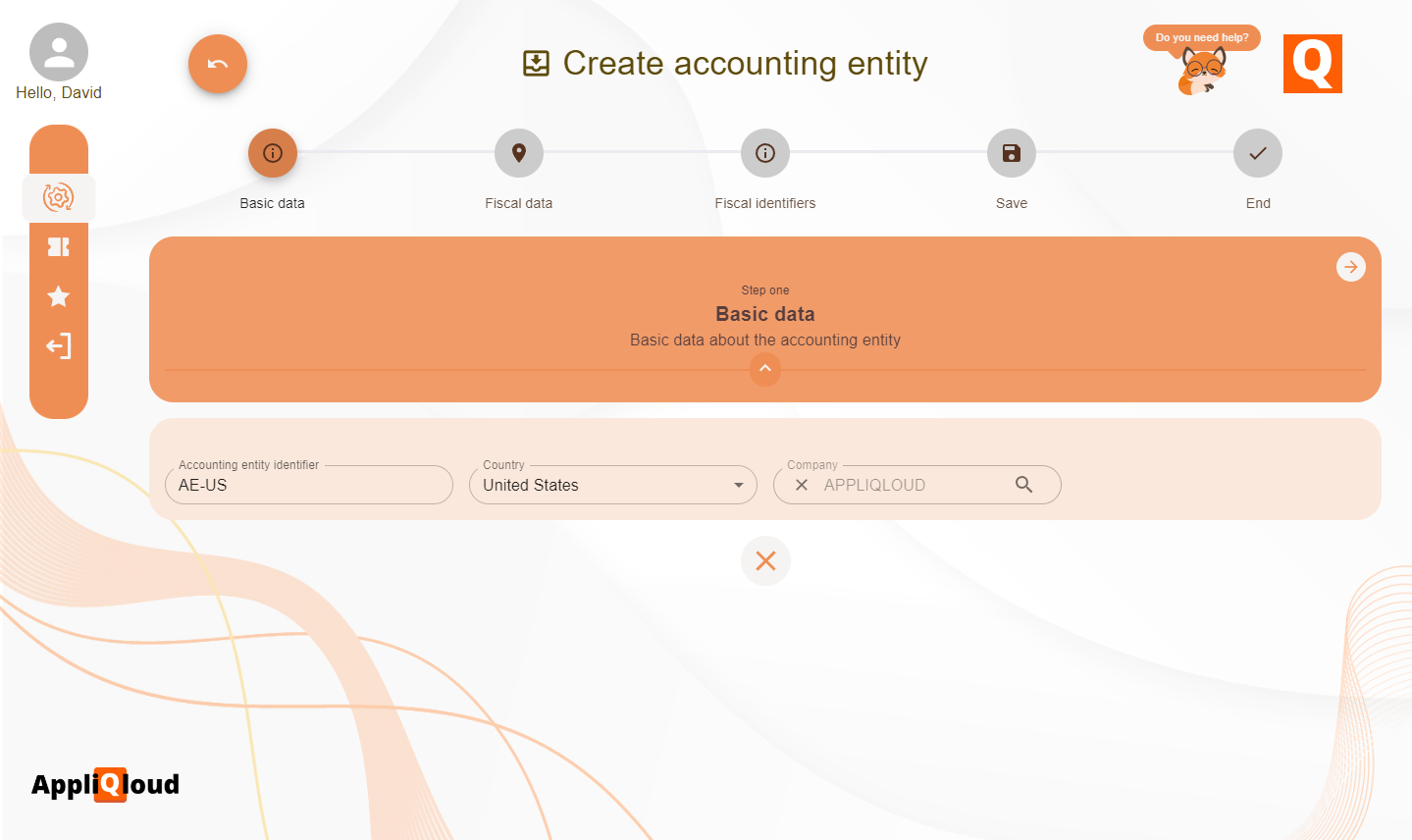

Accounting entities are objects associated with a company that contain fiscal information such as the fiscal identifier, fiscal name and fiscal address. To create an accounting entity, access the application through the Accounting entities card, and press the + button on the top right.

The first section captures data such as the entity identifier, the country in which this entity is based and the company to which it belongs.

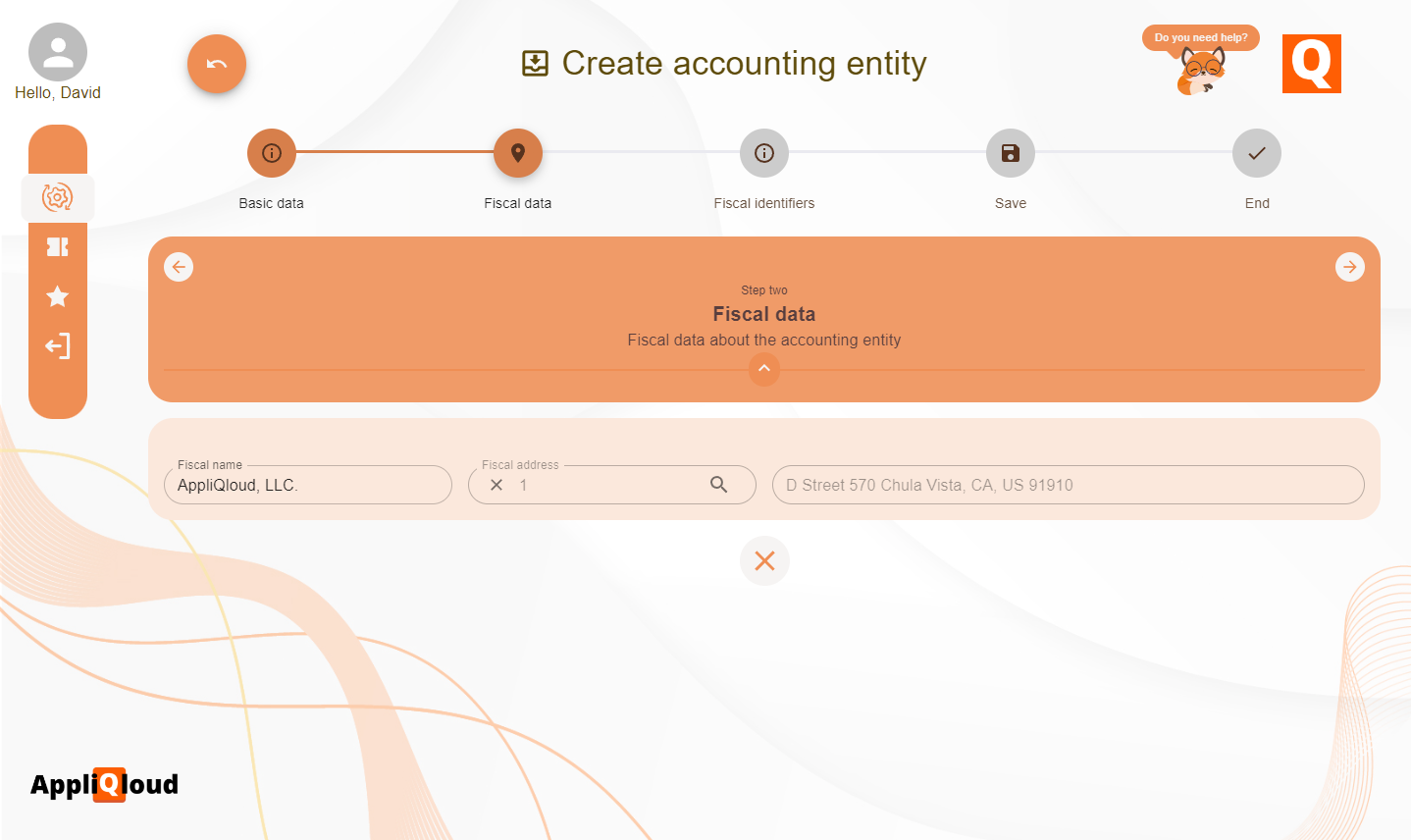

The next step captures the basic fiscal data, like the fiscal name and the fiscal address (a Location object). Once you select a location, verify that the loaded address is correct.

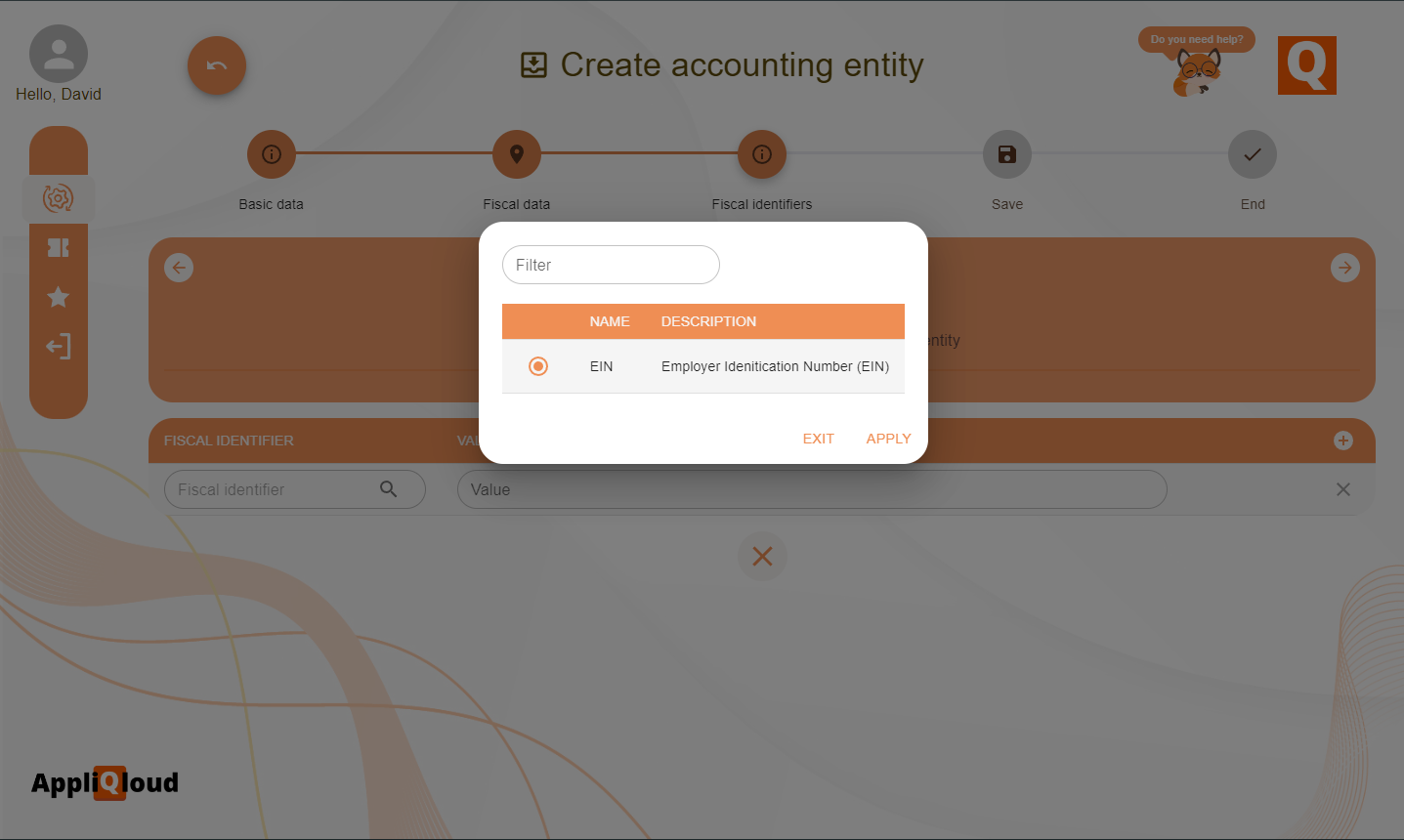

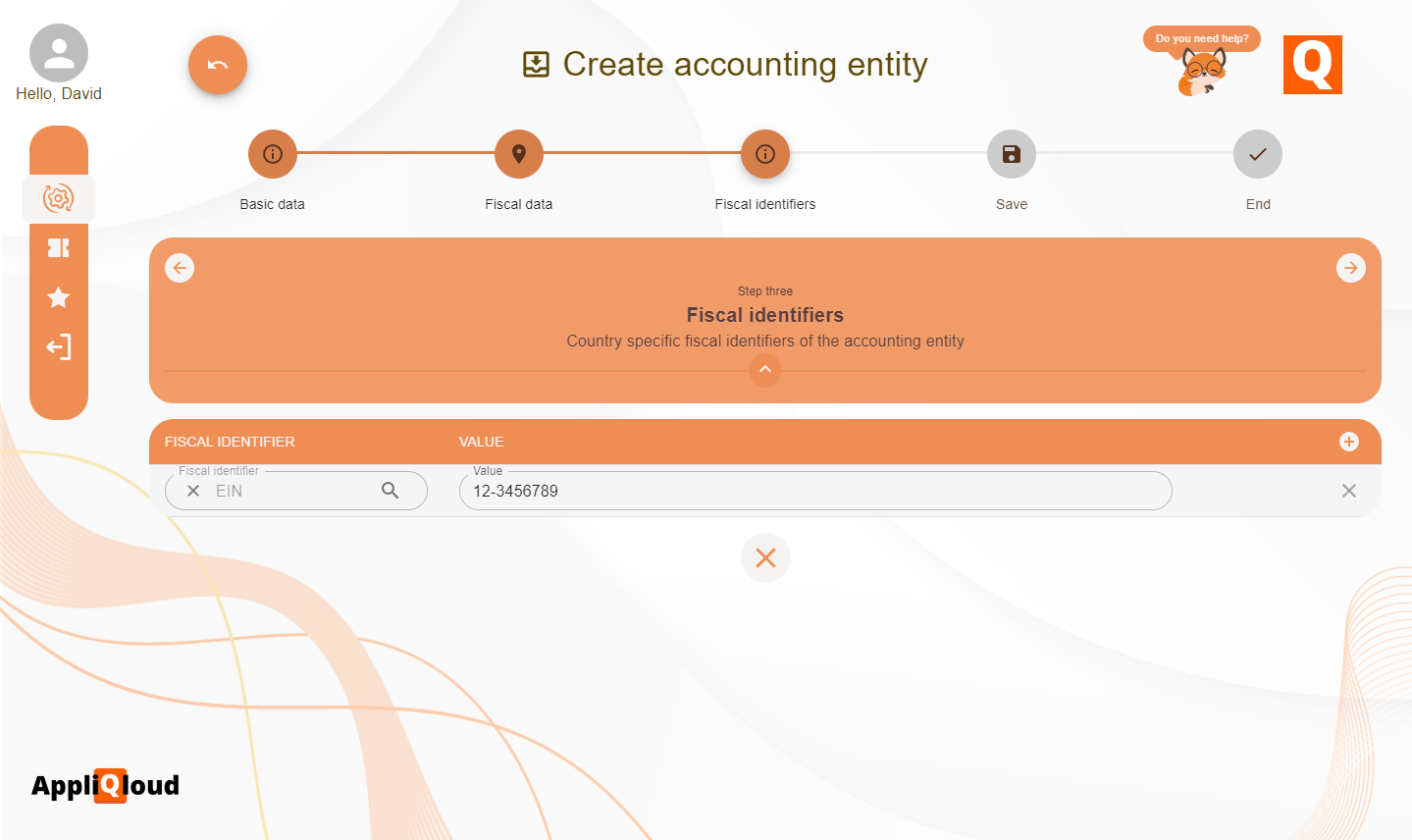

The final step is to enter the fiscal identifiers of the entity. These identifiers vary depending on the selected country, for example, if your accounting entity is based on the US, you will need to enter an EIN (Employer Identification Number), but if the entity is based on Mexico, you will need to provide the RFC (Federal Taxpayer Registry) and the fiscal regime.

Once you save the entity, you should see the newly created object in the reports page. For this guide, we will create two different accounting entities, one for the US and one for Mexico.